$300 - $15,000 Jacksonville, FL PAYDAY LOANS and

The Ultimate Guide To Paycheck Protection Program (PPP) loan - SBA

A Payday advance, likewise referred to as a Payday Advance, is a short-term loan utilized to assist with little, typically unexpected costs. Payday advance loan are usually repaid on your next pay date, typically in between two to 4 weeks. These small-dollar loans are a safe and convenient method to stretch your purchasing power when it matters most.

Get Cash advance Guide - Payday loan - Get your paycheck today - Microsoft Store en-HK

Where can I get a fast cash loan? At Check out Money, we make it quick and easy to get the money you require. Whether getting a Payday Loan online or checking out among our retail areas close by, we're proud to use hassle-free borrowing alternatives. Just how much money can I obtain? State laws control the optimum Payday advance loan quantities.

Payday Loans: A Matter of Life and Debt - Franklin DAzar & Associates, P.C.

The Payday advance you get is based on your eligibility and ability to pay back.

Payday Loans / Payday Advances Jacksonville, FL - Amscot Can Be Fun For Anyone

What's the distinction between personal loans and payday advance? While they may sound similar, they are significantly various financial tools commonly utilized by people with very various financial requirements. A is a "reasonably small quantity of cash lent at a high interest rate on the agreement that it will be paid back when the debtor gets their next paycheck," as defined by the Customer Financial Security Bureau.

There are some other crucial distinctions between personal loans and payday advance loan. We have actually outlined the essentials: Loaning limitations Payday loans are commonly small, short-term loans, with loan quantities typically varying from $100 to $1,000. The amount you can obtain with a personal loan might vary from $2,500 to $35,000. This Piece Covers It Well for individual loans consist of settling higher interest costs or spending for wedding event expenses.

These charges may be as much as 10-30 percent of your loan. That doesn't consist of any extra late charges if you are not able to pay back the loan on time. Depending upon your loan provider, individual loans can include their own set of charges. An origination cost is a fee deducted from your loan quantity upon participating in an agreement.

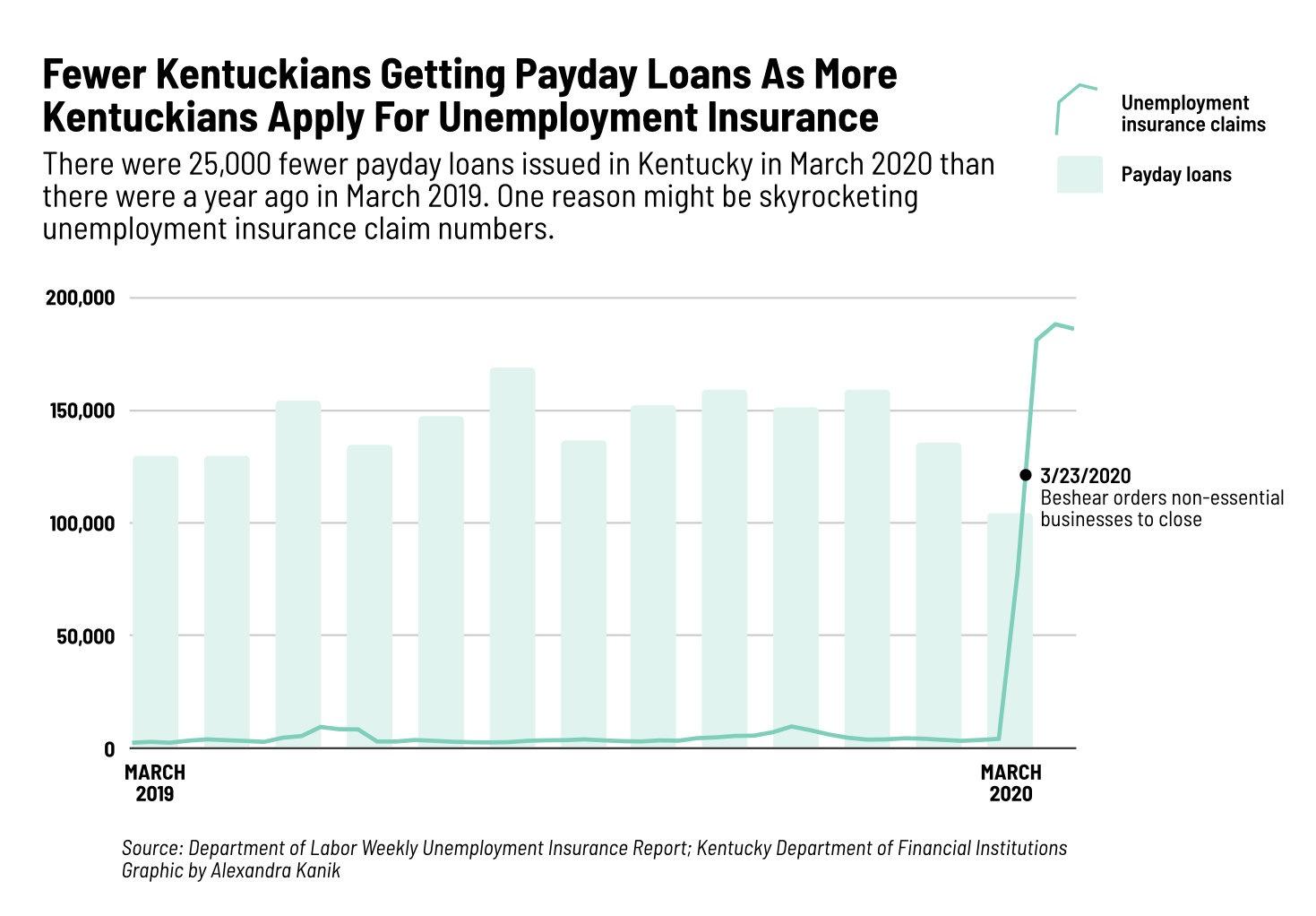

High Interest Payday Loan Lenders Target Vulnerable Communities During COVID-19 - Here & Now

The Greatest Guide To WorkPlaceCredit®- Bad Credit Employee Loan Solutions

Some loan providers may likewise include a prepayment charge if you were to pay off your loan before an agreed-upon time period. The good news is that some lenders do not include these loan fees, so you might prevent them if you do a little research on loan providers. Discover Personal Loans, for example, doesn't include any origination charges or prepayment fees as part of their personal loan terms.